The Bitcoin mining difficulty has reached a new all-time high of 95.67 terahashes (T), marking a 3.9% increase from the previous level. This surge in difficulty, the 13th positive adjustment for 2024, is accompanied by a record-breaking hashrate exceeding 700 exahashes per second (EH/s) for the first time. The mining difficulty measures the level of complexity in mining a new block on the Bitcoin network and has seen a substantial 27% increase from 72T to 92T year-to-date.

The network adjusts the difficulty every 2,016 blocks, approximately every two weeks, to maintain an average block mining time of 10 minutes. This increase in difficulty poses challenges for miners as it becomes more expensive to generate profits, leading to higher operational costs and the need for more efficient mining equipment.

Since the Bitcoin halving in April, there has been a trend of weaker miners exiting the market due to unprofitability. These miners, primarily small private entities, either sold their holdings or unplugged from the network, resulting in a 15% decrease in hashrate. However, data from Glassnode suggests that remaining miners are adapting to the new environment, with miner balances showing signs of accumulation since July.

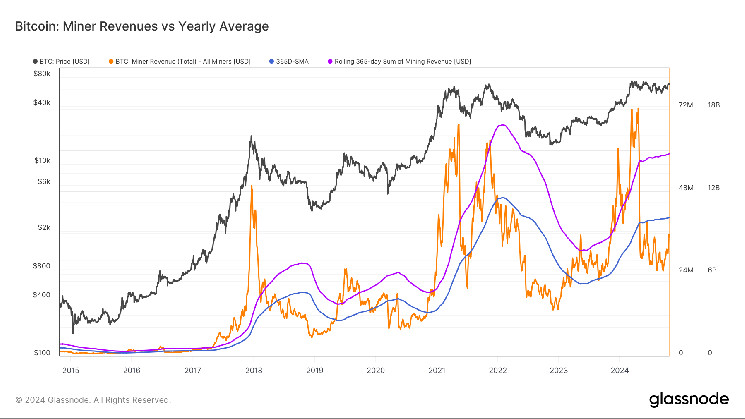

The mining industry is expected to consolidate into stronger hands, with public miners now controlling nearly 30% of the market share. As miner revenue increases, so does the potential for a Bitcoin bull run. Glassnode data indicates that total mining revenue has surpassed $35 million on a 7-day moving average, with a historical trend showing that once revenue exceeds the 365-day simple moving average of $40 million, a bull run may follow.

Overall, the current surge in Bitcoin mining difficulty and hashrate, coupled with a potential increase in miner revenue, suggests a positive outlook for the cryptocurrency market. With miners adapting to the challenging environment and signs of accumulation among remaining players, the stage may be set for a bullish trend in the near future.