The United States stands at a crucial juncture in the rapidly evolving world of digital assets. With the Trump administration’s focus on boosting prosperity for all Americans, there is a unique opportunity to establish the U.S. as a global leader in the realm of cryptocurrencies, particularly Bitcoin. One bold and transformative policy that could supercharge wealth creation for average citizens and solidify America’s position as the world’s leading “Bitcoin Superpower” is the elimination of capital gains taxes on Bitcoin.

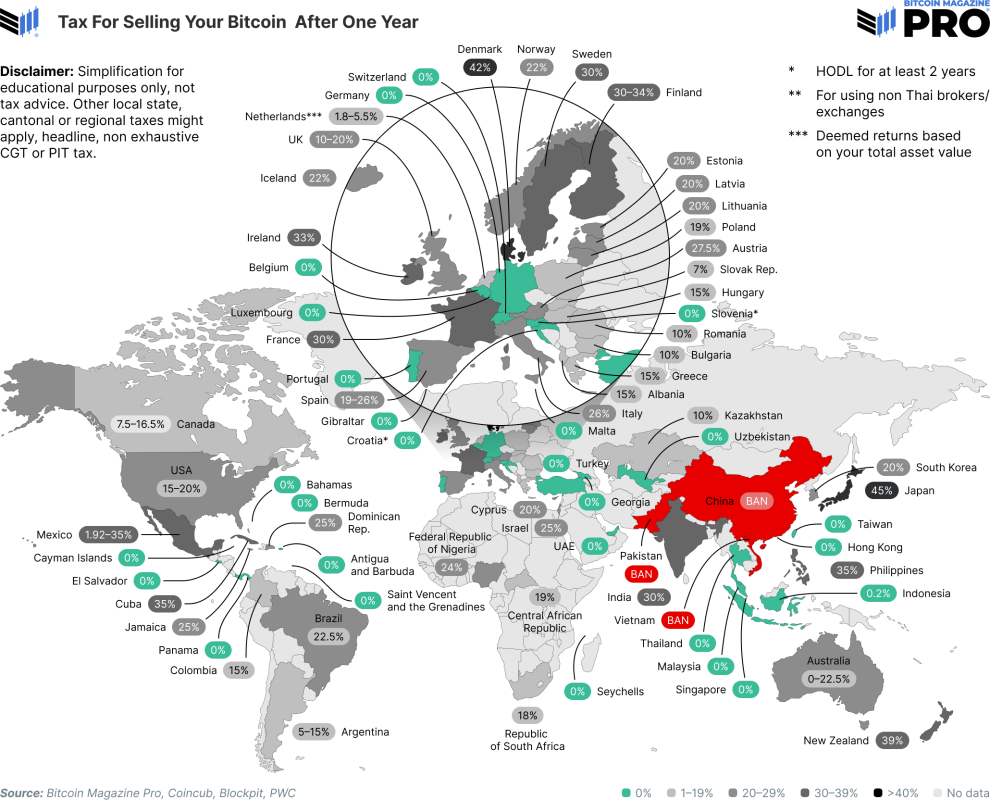

Looking at examples from around the world, countries like the Czech Republic, Switzerland, Singapore, and El Salvador have recognized the benefits of minimal or zero capital gains taxation on Bitcoin. These policies have led to increased adoption, financial innovation, and consumer confidence in these nations. By following in their footsteps, the U.S. can leverage Bitcoin as a tool for economic growth and prosperity.

President Trump himself has expressed a willingness to reevaluate Bitcoin taxation, acknowledging the absurdity of taxing small transactions like buying a cup of coffee with Bitcoin. His vision for America to become the world’s “Bitcoin Superpower” and his appointment of a “White House A.I. & Crypto Czar” signal a commitment to embracing cryptocurrency innovation.

One significant step in this direction is the BITCOIN Act of 2024, which mandates the creation of a strategic Bitcoin reserve by the U.S. Treasury. By eliminating capital gains taxes on Bitcoin, the government can create a positive feedback loop between national policy and personal prosperity, allowing citizens to transact and invest in Bitcoin without facing punitive tax obligations.

For everyday Americans grappling with the rising cost of living and inflation, Bitcoin offers a viable solution to preserve and grow wealth. By removing capital gains taxes on Bitcoin, individuals can engage in transactions, investments, and savings without the burden of federal taxes on every gain. This, in turn, can lead to increased demand for Bitcoin, strengthening the nation’s wealth base and benefiting the economy as a whole.

As more Americans embrace Bitcoin and cryptocurrency, the U.S. has the opportunity to lead in this digital revolution. By aligning with global best practices and enacting forward-thinking policies, America can position itself as a beacon of financial liberty and technical innovation. Removing capital gains taxes on Bitcoin would not only fulfill a campaign promise but also set the stage for long-term prosperity and economic growth.

In conclusion, America has the chance to innovate, adapt, and lead in the digital economy by embracing Bitcoin wholeheartedly. By eliminating capital gains taxes on Bitcoin, the U.S. can empower its citizens, secure its financial future, and establish itself as the world’s foremost Bitcoin champion. This move would not only benefit everyday Americans but also cement America’s position as a global leader in the 21st-century digital economy.