Ethereum (ETH) is currently trading at a price that is approximately 11% lower than its recent highs of around $2,730. Despite this dip, investors are hopeful for a potential price surge in the near future, fueled by positive on-chain data.

Key metrics provided by Glassnode indicate a decrease in the inflow of ETH into exchanges, suggesting that investors are holding onto their assets instead of selling. This trend often indicates increased accumulation and could signal a bullish breakout on the horizon.

Related Reading

As the overall crypto market landscape evolves, Ethereum investors are staying alert, anticipating a bullish resurgence that could drive prices higher. The decline in exchange inflows may indicate that traders are positioning themselves for a potential upward movement, showing a preference to retain their holdings during this critical phase.

If Ethereum successfully breaks above key resistance levels, it could reignite bullish momentum and attract additional investment. The next few days will be crucial for ETH, as traders closely watch price movements and on-chain data for signs of a comeback. With favorable conditions, Ethereum could aim for new highs, reinforcing the positive sentiment in the market.

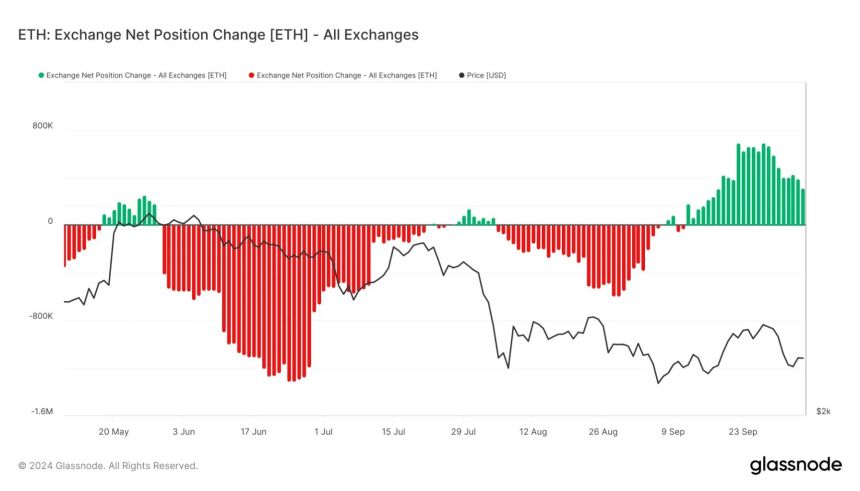

Ethereum Exchanges’ Net Position Change Decreases

Ethereum (ETH) is currently at a pivotal price level following a 15% decline from its recent highs. The broader crypto industry is eagerly awaiting a major rally after the Federal Reserve’s decision to lower interest rates a few weeks ago. Despite the optimistic outlook, prices have struggled to rise, leaving many investors anxious.

Fortunately, on-chain data from Glassnode suggests a reduction in selling pressure, which could boost market sentiment and pave the way for a potential ETH recovery. One important metric to consider is the Ethereum Exchanges’ Net Position Change indicator, which has been trending downward since mid-September. This indicator tracks the movement of ETH into and out of exchanges, and its recent decline indicates a significant drop in inflows.

Reduced inflows typically indicate decreased selling pressure, as fewer investors are transferring their assets to exchanges for selling. This shift in momentum reflects a positive change in market sentiment, suggesting that investors may be less eager to sell their holdings at current price levels.

With a decrease in selling activity, Ethereum could have the opportunity to recover from its recent decline.

Furthermore, growing confidence among investors could lead to upward price movement in the upcoming days. If this trend continues, Ethereum might be primed for a resurgence, potentially paving the way for a bullish breakout as market dynamics shift in its favor. As traders stay watchful, all attention will be on ETH to see if it can capitalize on this improved sentiment and regain upward momentum.

ETH Testing Crucial Supply Levels

Ethereum (ETH) is currently priced at $2,448 after facing rejection at the 4-hour 200 exponential moving average (EMA) at $2,516. The price struggled to sustain momentum above the 4-hour 200 moving average (MA) at $2,458, signaling a critical juncture for ETH. Failure to reclaim both of these key levels in the coming days could put Ethereum at risk of dropping towards the $2,200 range, potentially triggering a deeper correction.

Conversely, if ETH can break above and maintain these critical indicators, it could indicate a bullish trend reversal, potentially leading to a surge towards the $2,700 resistance zone. The outcome in the next few days will be crucial in determining Ethereum’s path.

Related Reading

Traders and investors will closely watch these levels, as reclaiming them could provide the momentum needed for ETH to regain strength and aim for higher price levels. The current price action reflects market uncertainty, underscoring the importance for ETH to assert itself decisively to instill confidence and drive a rally.

Featured image from Dall-E, chart from TradingView