オットキャスト OTTOCAST PICASOU2 Pro CarPlay AI Box エアマウスセット ピカソウ2 プロ Android HDMI出力 ワイヤレス GPS 動画 正規品

タイムセール

タイムセール

999円以上お買上げで代引き手数料無料

商品詳細情報

| 管理番号 | 新品 :69450033 | 発売日 | 2024/12/11 | 定価 | 44,999円 | 型番 | 69450033 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

オットキャスト OTTOCAST PICASOU2 Pro CarPlay AI Box エアマウスセット ピカソウ2 プロ Android HDMI出力 ワイヤレス GPS 動画 正規品

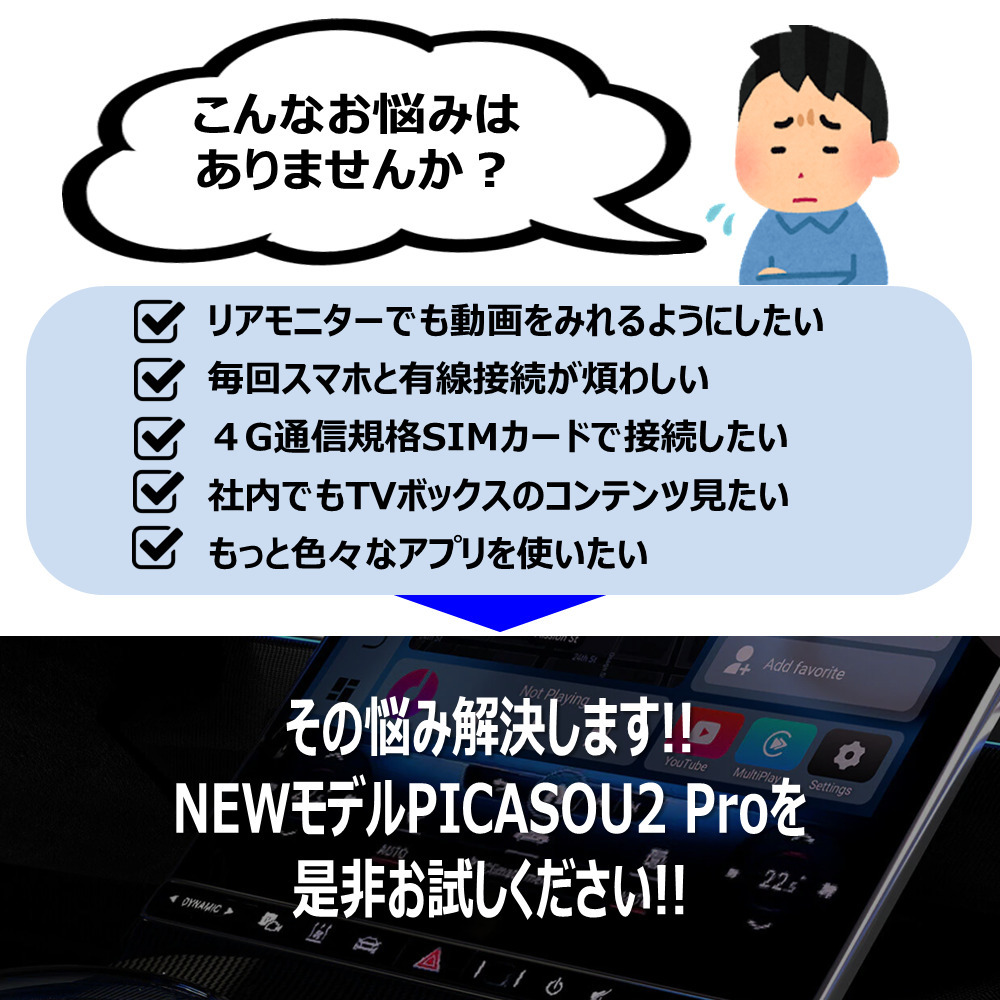

オットキャスト OTTOCAST PICASOU2 Pro CarPlay AI Box 【2023年版 NEWバージョン エアマウスセット】 ピカソウ2 プロ Android 大容量 HDMI出力 SIMカード

◆Point1◆「本製品は、OEM製品のためメーカーロゴは入っておりません」 ロゴの有無以外、技適も含めOTTOCASTのPICASOU2 Pro CarPlay AI Boxと全く同一の正規品です。

◆Point2◆「OTTOCAST 2023年新発売 最新ハイスペックモデル登場!」 OTTOCAST Android 10.0搭載 PICASOU2 Pro CarPlay AI Boxは、最新クアルコム社製8コアチップ「Qualcomm Snapdragon SDM6125」を採用し、操作した時の動きが従来品より大幅にアップしました!豊富な入出力端子で拡張性がアップグレード!ミニHDMI出力&HDMI入力機能が追加されました。またNano SIMスロット搭載でSIMカードがあればスマホのように使えます!さらに、USB Aポートを装備し、USBメモリやDVRなどを接続することができます。パフォーマンスが向上して、さらに快適に使用できるようにアップグレードしました!また、ワイヤレスCarPlay & ワイヤレスAndroid Auto機能追加されました!

◆Point3◆「最新クアルコム8コアチップ「Qualcomm Snapdragon SDM6125」 2.0Ghz採用 & 4G RAM+64GB ROMの大容量メモリ」 GPSが本体に内蔵され、GPSユニットは外部接続不要です。また低ノイズアンプ(LNA)モジュール採用のため、弱い信号を増幅することでトンネルや山間部等でも精度の高い位置情報を取得します。Google Mapやカーナビが使えて大変便利です。

◆Point4◆「HDMI出力機能追加で後部座席のリアモニターで動画が楽しめる!対応アプリ拡充」 Androidベースで動き、車載モニターがアンドロイドタブレット化!GooglePlayストアからお好きなアプリをインストールすることができます。動画アプリ(YoutubeやNetflix等)、音楽ストリーミングアプリやカーナビアプリ(!カーナビ等)など自由にお好きなアプリを入れて快適に楽しめます。さらに本体にTFスロットがあるので、TFカードに入れた動画や音楽を視聴することもできます。

◆Point5◆「マルチディスプレイ表示!」 画面を左右に2分割表示できます。2つのアプリを同時使用可能です。

◆Point6◆「ワイヤレスCarPlay&Android auto機能追加!HDMI入力機能搭載でTVボックス等に接続可能」 ワイヤレスcarplayアダプタを純正のUSBポートに接続するだけで、有線接続のCarPlayをワイヤレス化。iPhone/android両対応です。Nano SIMカード対応・デュアルバンドWIFI対応

◆Point7◆「簡単取り付け」 車のCarPlay対応のUSBポートに接続するだけなので、誰でも簡単にインストールできます。※動画アプリ視聴にはWi-Fi環境が必要になります。スマートフォン(デザリング契約)もしくは、モバイルWi-Fi/車載Wi-Fi等のインターネット環境をご用意ください。純正USB Type-Cの場合は、付属のUSB-C to Cケーブルで接続してください。

◆Point8◆「デュアル Bluetoothモジュール内蔵」 Bluetooth4.2/Bluetooth5.0に対応しています。Bluetooth通話に対応可能なだけではなく、Bluetoothマウスやリモコン等の 外付デバイスにも接続できて、より便利なドライブ環境を実現します。

◆Point9◆「多様な車種に車の純正操作が続行可能」 操作や音声の遅延がなく、有線 ◆Point10◆「多様な車種をサポート」 基本的に2016年以降の純正で有線CarPlay搭載車種をサポートします。

【商品仕様】 ■製品型番:PICASOU2 Pro CarPlay AI Box ■OS: Android 10.0 ■CPU: Qualcomm Snapdragon 665 8コア 2.0Ghz ■メモリ:4GB ストレージ容量 64GB ■SIM:2G/3G/4Gの通信規格に対応(nano SIM対応) ■Bluetooth対応規格: Bluetooth4.2/Bluetooth5.0 ■Wi-Fi対応規格:デュアルバンド802.11 b/g/n/ac 2.4 G+5GHz ■GNSS:GPS、GLONASS、Beidouが内蔵 ■端子:mini HDMI出力ポート、mini HDMI入力ポート、Nano SIMスロット、USB-A ■拡張可能なメモリ:USBメモリ(最大128?) ■動作温度:-30℃~75℃ ■動作電圧:5V~1A(USB plug and play) ■適用車種:2016年以降の純正CarPlay搭載車種のみ ■カラー: ブラック ■本体寸法:103*64.5*22mm ■本体質量:79g ■本体接続端子:USB-C(車両通信・電源供給用) ■認証:日本国内の電波法(TELEC)認証済 ■パッケージ内容:本体x1、エアマウスx1、USBケーブル2本(Type-C/Type-C、Type-C/Type-A)、取扱説明書x1

【注意事項】 適合車種は随時更新されます。ご購入前に必ず現車にてCarplay搭載有無、適合車種リストの情報をご確認ください。 ※本製品は、OEM製品のためメーカーロゴは入っておりません。ロゴの有無以外、技適も含めOTTOCASTのS35と全く同一の正規品です。 ※車がCarPlayに対応していない場合は使用できません。確認方法としては、iPhoneをLightningケーブルで車載カーオーディオのUSBポートに差し込み、iPhone画面に「CarPlayを使う」と表示されたら、CarPlayを搭載していることを確認することができます。 ※タッチパネル操作ができないディスプレイ搭載車ではBlueToothでエアーマウス等と別途繋げば操作可能です。 ※本製品は運転者以外の同乗者が走行中に動画を楽しむためのものです。運転者が走行中にAV機器に表示された画像を注視することは道路交通法で禁じられています。 ※本製品だけではインターネットに接続はできません。長時間の動画再生する場合はパケット使用量にご注意ください。アプリやOSの仕様で一部作動しない場合がありますので、ご了承ください。

【注意事項】 新品未開封品につき、動作確認などは行っておりません。クレーム・返金・交換などはお受けしておりませんので、ご理解いただける方のみ、よくご納得の上で入札をお願い致します。

+ + + この商品説明は オークションプレートメーカー2 で作成しました + + +

No.107.002.002