One analyst has outlined a potential scenario where Ethereum could experience a significant drop to as low as $1,800 if it loses a crucial on-chain demand zone.

Ethereum Faces Critical On-Chain Support Test

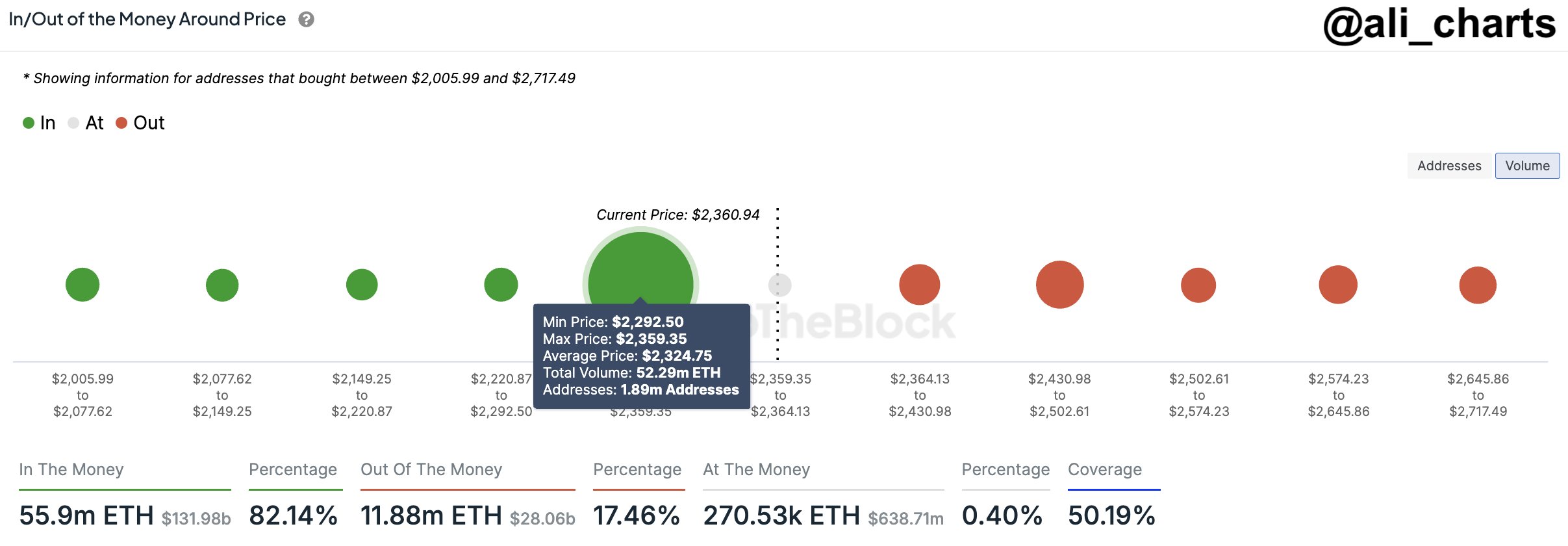

In a recent report on X, analyst Ali Martinez delves into Ethereum’s current investor cost basis distribution using data from IntoTheBlock, a market intelligence platform.

The chart illustrates the amount of ETH purchased within specific price ranges, with the $2,292 to $2,359 range standing out due to substantial buying activity in that zone.

Approximately 52.3 million ETH was acquired by 1.9 million addresses within this range, indicating a concentration of investors with break-even points in this zone. Any price movement within this range could trigger reactions from these investors.

While minor price ranges may not significantly impact the market upon retesting, larger demand zones, like the one highlighted for Ethereum, could lead to significant price fluctuations.

A retest of a major demand zone from above, where investors were previously in profit, often results in buying activity as holders seek to capitalize on the perceived opportunity. Ethereum’s current retest of the $2,292 to $2,359 range could potentially find support and bounce back.

However, if this critical demand zone is breached, the analyst warns of a potential sell-off that could drive Ethereum towards $1,800, representing a significant 21% drop from the current price.

Ethereum Price Analysis

Following a retracement from recent gains, Ethereum is trading at $2,300, within the crucial price range under scrutiny.

As the market awaits further developments, the fate of Ethereum hinges on the resilience of its on-chain support zone.

Image credits: Dall-E, IntoTheBlock.com, chart from TradingView.com