【伝来_弐】hp313 真作保証 クリフトン・カーフ 作 蛙徳利 全面書きの共箱 木版画 アメリカ人

タイムセール

タイムセール

999円以上お買上げで代引き手数料無料

商品詳細情報

| 管理番号 | 新品 :40481236 | 発売日 | 2024/07/26 | 定価 | 75,000円 | 型番 | 40481236 | ||

|---|---|---|---|---|---|---|---|---|---|

| カテゴリ | |||||||||

【伝来_弐】hp313 真作保証 クリフトン・カーフ 作 蛙徳利 全面書きの共箱 木版画 アメリカ人

詳細、追加画像が説明欄にございます。

Ea12hp6ha

こちらの商品は弊社(大阪市)で実物をご覧いただけます。

ご希望の場合はご連絡くださいませ。

メール hannari875@art-en.jp

06-6251-1355

状態・サイズ・作家説明

◆真作保証いたします◆

状態:良好

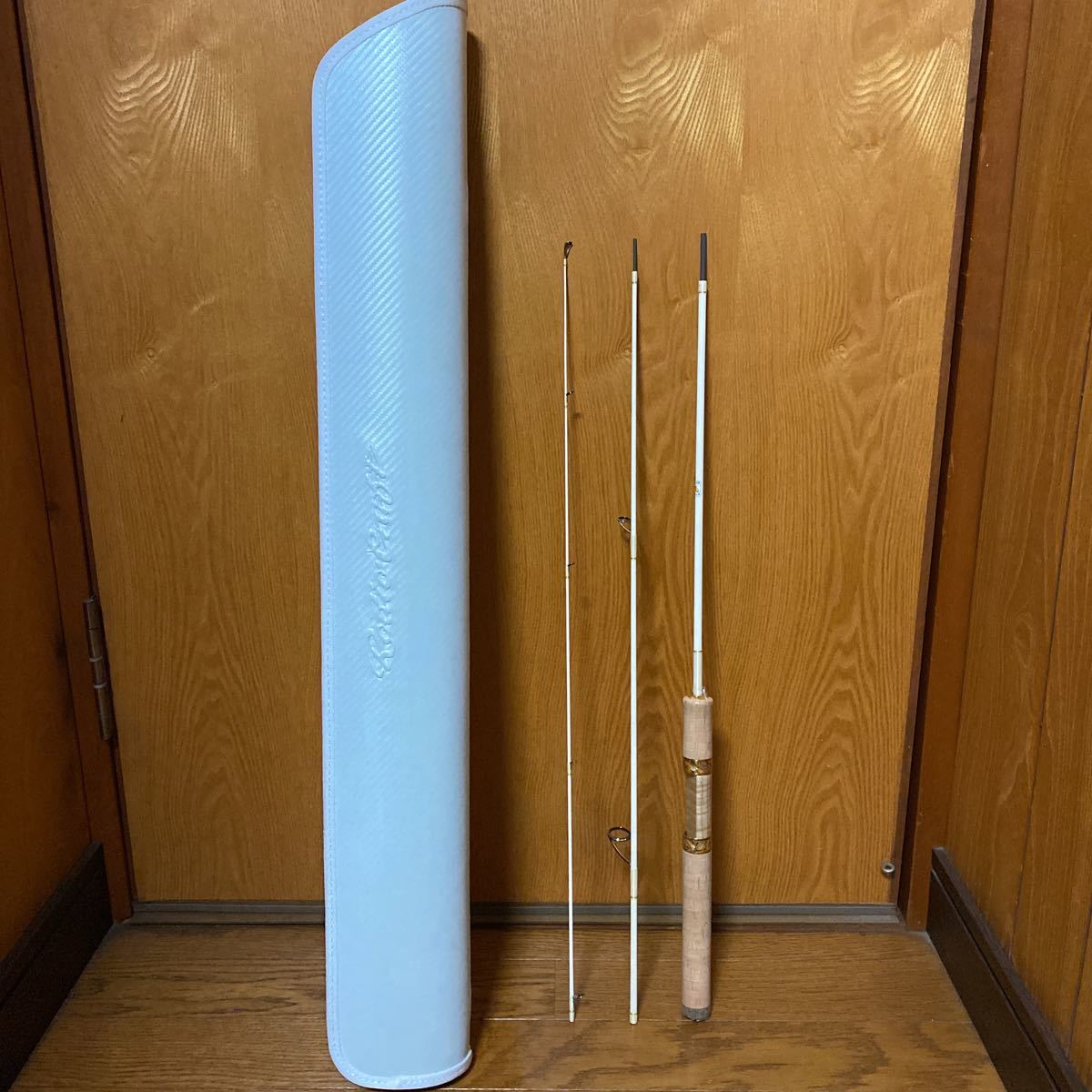

本体サイズ

口径:2cm

直径:8.5cm

高さ:13.5cm

共箱

重量:400g

重量:175g(中身のみ)

【クリフトン・カーフ】1927-2007

アメリカ合衆国ミネソタ州ダルーズ生まれ。木版画家。1955年から日本に暮らし、風景や建物を描き続ける。版木の重ねかたで毎回色も変わるので、同じものをたくさん作る版画ではない。また最後に版木を自身で壊してしまうので、これから先も新たに擦る事が出来ないので希少価値がある。28歳から32歳までを岐阜市の長良川沿いに暮らす。その後、京都で有名になり、晩年は石川県金沢市主計町茶屋街に移住。以後12年間、茶屋跡に住居兼アトリエを構え、主に金沢の風情を描いた作品や墨絵の創作活動に励んだ。

お

銀行振り込み(りそな銀行)

ゆうちょ銀行

クレジットカード決済(!かんたん決済)

・オークション終了後は、速やかに『オーダーフォーム』よりご連絡をお願い申し上げます。

弊社からの連絡は基本的にメールのみでございます。

(弊社はオークションストアですので取引ナビがご利用できません)

・複数商品を同梱希望の方は、オーダーフォームを1点1点ご自身でご入力いただいた後にお

配送

佐川急便で配送(その他配送・着払い)ご了承お願い致します。

落札金額に下記送料を加算させていただきます。

※在庫管理の関係上、ご入金から発送まで数日猶予を頂く場合がございます。

※額装の場合や、商品サイズ、性質、数量によっては同梱できない場合がございます。予めご了承ください。九州四国中国 関西北陸東海860860750750熊本 宮崎

福岡 佐賀

長崎 大分

鹿児島 香川 徳島

高知 愛媛岡山 広島 山口

鳥取 島根 京都

滋賀 奈良 大阪

兵庫 和歌山富山 石川

福井 静岡

愛知 岐阜

三重

信越 関東南東北北東北北海道86097010801510長野 新潟 茨城

栃木 群馬 埼玉

千葉 東京 山梨

神奈川 宮城

山形

福島青森

秋田

岩手北海道

留意点

こちらのIDで出品しております【真作】は弊社で判断したものとなります。

作品をお受け取り後、お客様自身で所定の鑑定機関で鑑定し、真作ではないと判断された場合のみ返品お受けいたします。

自己判断での真贋の判断では受付いたしかねます。

状態(オレ・シミ・イタミ・その他)は画像でよく御確認の上ご入札ください。

特に記載がない場合、箱等の付属品は画像にあるものが全てです。

We can ship this item to Worldwide.

Please contact us for additional shipping costs and services.

※商品に関するご質問は、落札日の当日17時までにお願い致します。弊社の営業時間(土日祝を除く9-17時)のみ、ご回答が可能です。

※土日祝日は休業させていただきます。御連絡、発送は翌営業日になりますので御了承ください。

※終了当日・直前のご入札の取り消しはトラブルの原因となりますので、ご遠慮いただきます。ご入札の際はお間違いのないようお気を付け下さいませ。

※ご入札いただきますとお買い上げ責任が生じます。お客様都合でのキャンセルは一切受け付けておりません。

※ご使用のブラウザやパソコンのモニター環境などによっては、多少色合いなどが実物とは異なって見える場合があります。ご理解の上、ご自身がご納得いただけます価格でのご入札をお願いいたします。

お知らせ(必ずお読みください!)

■■利用規約について■■

商品点数増加の為、円滑なお取引を目的として新たに「利用規約」を策定いたします。

下記リンクから内容をご確認の上、ご入札の検討くださいますようお願い申し上げます。

株式会社 縁 ストア利用規約

【重要なおしらせ】

商品の制作年や元の持ち主様の保存状態等により、経年劣化が進んでいることがございます。

作品のダメージにつきましては、すべての出品物は骨董品、品ですので説明しきれない時代物としてのシミ・イタミ・シワ・剥脱・ヤブレ・ヤケ・変色等見られます。目立つダメージは明記しておりますが、画像では見にくい細かなダメージがある場合がございます。骨董品・美術品としての特性としてご理解いただけます場合のみご入札をお願いいたします。

軸先については、当時の接着剤の膠(にかわ)が劣化し、大半が外れやすい状態です。また、軸箱についても木材の劣化の度合いによっては非常に破損しやすいものです。

梱包/配送委託業者へは厳重な梱包と細心の注意をお願いしておりますが、何卒、ご理解賜りたいと存じます。

上記の理由から画像では軸先が外れていない場合も輸送中に外れることがございます。この点におきましては、誠に申し訳ございませんが、商品の特性上防ぎ切れかねますので、ご容赦くださいますようお願い申し上げます。

■評価システム

お客様への評価は、ご希望がない限り行っておりません。

評価をご希望のお客様は弊社への評価を頂ければ、確認の後、個別に弊社より評価の処理を致します。

※評価を希望されないお客様が弊社へ評価されますと誤ってこちらから評価の処理をしてしまうことがありますのでご注意ください。